Imagine you’re planning to buy a house. You wouldn’t finalize the deal without an inspection to check the plumbing, ensure the roof doesn’t leak, and verify that the asking price is reasonable in the current market.

Private Equity Due Diligence works the same way. It’s a detailed evaluation process to examine an investment opportunity before committing funds.

A well-executed, unbiased due diligence process can not only prevent financial losses but also identifies growth potential, uncovers synergistic opportunities, and reveals strategic advantages that impact business outcomes. It equips investors with a powerful tool to navigate their investment journey.

This article uses a practical example to walk through the due diligence process. We will demonstrate how an unbiased approach influences the results.

We will guide you through the unique client situation, the detailed due diligence objectives, the expert team behind the process, and the resulting deliverables.

We will also provide insight into 10EQS’ work and highlight their findings’ importance to the investment decision. By the end, you will understand the full scope of the private equity due diligence process and appreciate the undeniable value of impartial analysis.

The Unique Situation: Understanding the Client’s Needs

Our private equity client had a portfolio company in the energy storage market that wanted additional funding for continued growth and innovation. However, the process wasn’t as straightforward as signing a check.

The investor was at a crossroads. Investing further in a company is not just about the availability of funds but also about making an informed decision based on an analysis of the company’s current position.

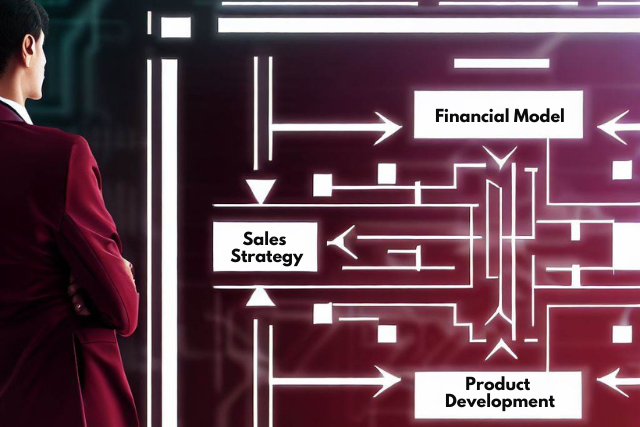

Our client knew there were several critical areas they needed to evaluate before moving forward with an investment.

- Product Development (Current)

- Product Roadmap (Future)

- Market Positioning

- Sales Strategy

- Financial Forecasts (Feasibility)

Why 10EQS: The Unique Value Proposition and Expert Team

Our client turned to 10EQS, given our reputation for delivering detailed, unbiased due diligence reports, our bespoke problem-solving approach, and our unique access to industry experts. Our attributes set us apart in a complex investment landscape.

Recognizing the specific skill set necessary for this complex project, we assembled an expert team tailored to our client’s needs. The team was led by an Ex-L.E.K./Capgemini Consultant, a veteran in due diligence, corporate strategy, and financial modeling.

This expertise, coupled with our Associate Consultant’s proficiency in secondary research and content synthesis, provided a thorough examination of the investment opportunity.

Supporting these roles, our 10EQS Delivery Operations (PMO) team was critical in maintaining quality assurance, managing the process, and ensuring access to the right industry expertise. Their role ensured the project was completed in just three weeks and met our high-quality standards.

Collectively, our team’s diverse skill set and access to industry expertise, combined with our dedication to quality, allowed us to navigate the investor through the complex investment landscape confidently.

This reinforces the power of an expert team and rigorous due diligence in making informed investment decisions.

Detailed Objectives: A Walkthrough of the Due Diligence Process

After understanding the client’s unique needs and the context of their investment, it became evident that a tailored approach to due diligence was required. So we customized our process to fit the client’s needs of conducting a thorough examination across multiple key areas.

The Key Areas of Due Diligence: A Step-by-step Walkthrough and Their Importance

Current Product Development Efforts

The first step of our due diligence process was understanding the target company’s current product development efforts. This step is similar to stepping into the company’s innovation lab, shedding light on the challenges faced, the problem the product aims to solve, and its adherence to market standards.

Our team conducted a deep dive into the energy storage product, its features, quality, cost, reliability, and how it aligned with the market standards.

Future Product Roadmap Assessment

The next step took us to the company’s future planning, where we uncovered the portfolio company’s vision for the future.

In this case, we examined the future product roadmap to assess the company’s innovative capabilities and whether they aligned with emerging market trends and customer needs.

Product-Market Fit

This step is similar to tuning into the market’s heartbeat and customers’ pulse.

We performed a comprehensive analysis to determine whether the portfolio company’s products satisfied market needs and had a unique value proposition.

Market Positioning and Competitive Analysis

Understanding the company’s position in the marketplace is like being in the middle of a chessboard, where every move matters.

For the portion of the due diligence process, we focused on the competitive landscape, identifying key competitors, their offerings, and how our portfolio company’s products stacked against them.

Sales Strategy

Evaluating a company’s sales strategy analysis is like stepping into its war room and seeing its plans for capturing market share and revenue.

Our focus here was on the company’s sales strategy, channels, customer relationships, and the effectiveness of its sales force.

Financial Analysis

The last step, a financial analysis, is equivalent to conducting a health check-up of the company. This part involved a thorough review of the company’s financial health, focusing on costs, burn rates, and financial forecasts.

The goal was to understand whether the financial forecasts were achievable given the company’s current and projected performance.

In due diligence, the power of understanding each of these areas is not just about gathering data. Instead, it’s about interpreting the story behind that data and its implications for the future of the investment.

The Work: Unpacking the Approach of 10EQS

We completed this exhaustive due diligence process in three weeks. The need for a swift turnaround introduced certain challenges, particularly the need to acquire in-depth insights about the company and its market within a limited timeframe.

However, our team was up to the task. We excel at sprints that combine efficiency with rigorous investigation.

The team conducted seven internal interviews with key stakeholders within the portfolio company. These included discussions with the CEO, CTO, and heads of key departments such as marketing and finance.

The purpose of these interviews was to gain a holistic view of the company’s current operations and its plans for future development.

Parallel to these internal discussions, we conducted five external interviews with industry experts and undertook comprehensive market research. The goal was to cross-verify internal perspectives, better understand the competitive landscape, and identify industry trends that could affect the portfolio company’s performance.

Detailed Review of the Methods

Our due diligence process was a balanced mix of primary and secondary research. Here, we’ll delve into some concrete examples to highlight the depth and versatility of the methods used.

For instance, in assessing the company’s current product development efforts, our team reviewed product blueprints and spoke directly with the company’s product development team. We also compared the portfolio company’s products with competing products on the market, giving a clearer picture of their competitive edge (or lack thereof).

Similarly, in evaluating the company’s sales strategy, the team scrutinized previous sales records, analyzed customer feedback, and assessed the effectiveness of the sales channels used. Interviews with industry experts complemented discussions with the sales team to understand the viability of the current strategy.

The financial analysis was rigorous, as it delved into the company’s cost structure and burn rates. The team examined financial statements, projections, and underlying assumptions. This analysis helped assess if the financial forecasts were achievable or overly optimistic.

These methods were critical in constructing a holistic view of the company’s current position and potential. They ensured that the analysis was detailed and cross-verified from different angles.

This thorough and efficient approach is the essence of 10EQS’s methodology and its commitment to delivering robust, unbiased analysis to inform crucial investment decisions.

The Deliverables: More Than Just a Report

For private equity due diligence, the final report is more than just a list of findings. It’s a comprehensive document that synthesizes all key aspects of the due diligence process and provides critical insights to guide investment decisions.

Connecting the Components to the Strategy

Each part of the final report is intrinsically linked to the overall due diligence strategy. Let’s unpack this connection with a few examples from this project:

Company Situation and Outlook

This section provided a comprehensive picture of the company’s current state and future prospects, serving as the foundation upon which the investment decision is based.

For example, we identified that the legacy product, the company’s sole source of sales, was uncompetitive in costs and features.

Evaluation of Strategic Options

The section on strategic options provided a roadmap for potential future scenarios, feeding into the risk assessment part of due diligence.

For this project, we defined key strategic options and the implications for the investors.

Customer Development Cycle

This part of the report helped our client understand the portfolio company’s growth potential and its ability to retain and attract customers – critical factors for any long-term investment decision.

Extracting Insights from Each Component

Each section of the final report offers unique insights that can guide the final investment decision. Here are some of those insights from our case study:

Executive Summary of the Company’s Current Situation

Allowed the investor to quickly understand the challenges the company was facing in terms of product competitiveness.

Management Financial Plan

After deep analysis, we determined the target company’s financial forecasts were not achievable, leading to the conclusion that the company’s financial situation was problematic.

Competitive Landscape

Our competitive analysis showed that the legacy product couldn’t compete with other offerings in the market, signaling significant risk for the investor.

The deliverables from the due diligence process go beyond a mere report. They provide actionable insights that feed directly into the decision-making process, thereby playing a pivotal role in guiding investment decisions.

This role is well-illustrated, where our report and the storyline behind the analysis helped the investor make an informed choice to discontinue the investment.

The Results: Unveiling the Outcome

The results of the due diligence process, handled by our, brought forward several critical insights that reshaped the investor’s perception of their portfolio company. And as we mentioned, it helped the client decided not to invest.

Implications of the Decision and the Importance of Unbiased Analysis

The investor’s decision to discontinue the investment, as advised by the 10EQS team, carried substantial implications.

First, it saved them from potential financial loss, given the portfolio company’s shaky financial outlook and uncompetitive product range.

Second, it showed the importance of conducting unbiased due diligence even when dealing with existing portfolio companies seeking additional funding.

Our approach uncovered the harsh truths that needed to be addressed, resulting in a decision to prioritize financial prudence.

A clear-eyed view of a company’s position, free from bias, can be the difference between a profitable exit and a financial fiasco.

Thus, the value of third-party support for due diligence, such as that conducted by our teams at 10EQS, cannot be overstated.

Powerful Conclusion: Harnessing the Lessons

Investors need a clear, unbiased view of their potential investment. Even in three weeks, you can deep dive into a portfolio company’s financial outlook, future prospects, and competitive landscape. Those insights are crucial for making an informed decision.

Key learnings:

- Due diligence plays a critical role in decision-making and risk reduction.

- Thorough due diligence can reveal important information affecting an investment’s viability.

The Value of 10EQS

What seemed like a promising investment in an energy storage company was found to be risky. This finding, the result of in-depth due diligence, protected the investor from a potentially bad decision.

10EQS’s approach, which includes internal and external interviews, strategic analysis, and financial modeling, has proven its worth by helping the client avoid a risky investment.

A Call to Action

In the complex private equity landscape, thorough due diligence is necessary. It gives investors the confidence to make decisions based on complete analysis.

The article is a reminder to always ensure due diligence is a core part of your investment decision-making process.

As an investor, your goal is to maximize returns while minimizing risk, and due diligence is a key tool to achieve this. Use it effectively, and you can navigate your investment journey with the confidence that every decision is based on solid analysis.

If you’d like unbiased and impactful support with your next due diligence project, click the button below to discuss your specific needs. We’ll be happy to discuss how we can help.