Robert Shiller won a Nobel Prize in Economics in 2013 yet when Quartz asked him how policymakers and investors should analyze the coronavirus situation, he simply said, “It’s hard to analyze it because we’ve never been here before.”

If Nobel laureates are unsure where markets are going, does it mean that it’s in vain for companies and investors to try to get a grasp of what the future will hold? Absolutely not. Renowned statistician, George Box, put it most succinctly when he wrote, “All models are wrong, but some are useful.” And when “useful” could equate to a large portion of your balance sheet, insight into the future of the market is indispensable.

Most companies do not have the budgets for comprehensive predictive analytics that require large data resources, data scientists, information technologists, and ideally artificial intelligence algorithms. But there are alternative ways to shed light on the uncertainty of the future. 10EQS has conducted numerous predictive exercises on the major markets and in this article, we share the key steps in forecasting market outcomes over the medium term.

Step 1: Choose a base case

For most markets, a base case prediction exists. For example, were we to forecast the price of Brent Crude oil for 2025, the base case would be the EIA prediction of $69 per barrel. The EIA has already done the hard modeling and it gives a head start to map the future of oil. In the case of no publicly available base case prediction, you can assume that there will be no changes to the status quo. This is extremely unlikely as change is inevitable, but it works as a canvas upon which to draw the possible disruptions to the current situation.

Step 2: Understand the fundamentals

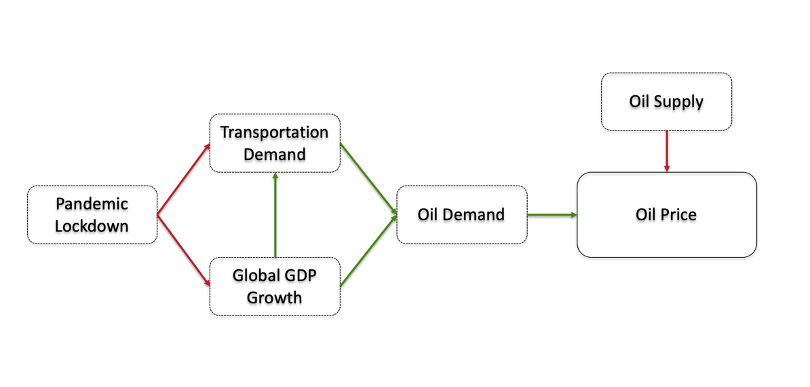

It is important to understand the fundamental influencers in whatever market you are evaluating. Personally, I make extensive use of mind maps to draw out and connect the sources of change and their positive or negative impacts. By doing so you may uncover factors that you never imagined would have an impact on the price or measurement you are forecasting. For example, the current COVID-19 pandemic was nearly impossible to predict. But understanding that a global lockdown would have a negative impact on GDP growth, as well as an immediate impact on transportation demand, helps to predict the magnitude to which the oil price will decrease.

Figure 1: An extract of an example market map. Red arrows indicate a positive correlation. Green arrows indicate a negative correlation.

Step 3: Outline the assumptions and methodology upon which the base case is built

The base case is built upon a wide range of assumptions to reach a conclusion for the market as a whole. But the assumptions and methodology should always be interrogated as they:

- May not all apply to your industry or sector

- May be outdated and need revision

- May contain errors, or

- May be biased by their publisher’s incentives

For example, in the case of the EIA Brent Crude prediction, it estimated that the price of oil would be $59 per barrel in 2020. Yet at the time of writing this article in late March 2020, the price of Brent Crude was only $26 per barrel. Does that mean that all future prices should be adjusted proportionally? Probably not. The current slump may just be a temporary lull due to the COVID-19 lockdown and prices will return to normal. Or it may be a shift in the long-term fundamentals only slightly exaggerated by the lockdown and all predictions need to be adjusted downwards. The only way to know is to analyze the underlying dynamics.

Step 4: Use experts and analysts to interrogate price influencing factors

Engaging with industry experts serves three major functions:

- Identify updates to the assumptions made in the base case

- Customize the base case predictions to the company’s specific needs or industry

- Introduce new factors not included by the base case scenario

At 10EQS, we specialize in engaging with experts and analysts through in-depth interviews. In addition, publicly available comments or reports from other sources can be used to adjust the base case scenario. For example, in the case of the EIA Brent Crude prediction, its assumptions and models can be checked against the IEA analysis of the supply and demand dynamics of oil. Television or written interviews with leading experts also provide insight, but it is crucial that the original opinions of the experts are used and not the interpretations or summaries of the journalist conducting the interview.

Step 5: Order and weight potential threats to the base case scenario

Once all the potential disruptors to the base case prediction have surfaced, weigh these according to their likelihood of occurrence and impact on the price were they to occur. For example, a war in the Middle East will have a larger impact on the oil price than a change in the Federal Reserve interest rate, but the latter is far more likely to occur and should therefore hold a greater influence on your ultimate prediction.

Step 6: Develop a scenario analysis on the top disruptors

Choose the top five or ten factors that are likely to influence the future of the market you are evaluating. By now, you will have an idea of how each of these will impact the price on their own. The final step is to combine them into possible outcomes based on their likelihood and impact and draw out the possible scenarios for the market over the medium term.

Ultimately, all market predictions rely on judgment. The steps outlined above will not predict the future, but they are a rapid and relatively inexpensive way to significantly reduce the margin between the forecast and the final outcome.

10EQS can support your predictive market assessment and scenario analysis during these unprecedented times. For your forecasts, we will assemble virtual teams of consultants and specialized industry experts to deliver insights and recommendations tailored to your firm’s unique needs.

Pierre Heistein has 10+ years’ experience in macroeconomic and market analysis. He has completed 25+ projects for 10EQS and is concurrently the Subject Matter Expert on Macroeconomics for the MIT Sloan School of Business where he facilitates its online course on Economics for Business. Prior to 10EQS he spent five years writing for Oxford Analytica on its Sub-Saharan Africa desk and six years as a weekly columnist for South Africa’s largest business publication.